Let our Antivirus Software Software Experts help you find the right Software for your Business!

AhnLab Review

- Ahnlab free download - xkeeperahnlab, V3 Mobile Security - Free, V3 Mobile Plus 2.0, and many more programs.

- 총판/파트너/조달 구매 문의. 파트너 찾기; 오프라인 구매 기업 고객. E-Licensing Service.

- AhnLab will be a company. That contributes to the.

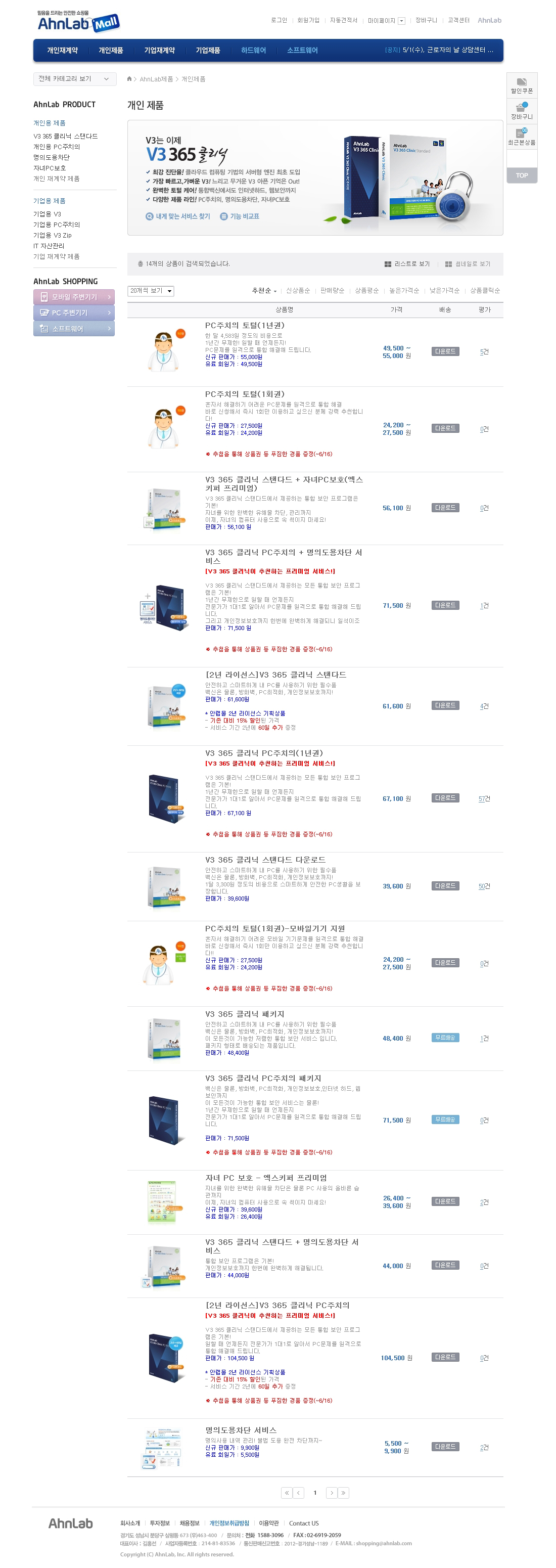

안랩몰은 안랩에서 운영하는 온라인 판매처입니다. 개인용 v3 365 클리닉과 기업용 v3를 온라인으로 쉽고 빠르게 구매하세요. The contents of the HackShield page were merged into AhnLab, Inc. For the contribution history and old versions of the redirected page, please see; for the discussion at that location, see its talk page Copvios? I don't think this page was an Copyvio. Andewz111 (typo intended) 15:23, 8.

AhnLab is a growing cloud-based Antivirus Software software, it is designed to support small, medium and large size business. AhnLab received a rating of 3.7 from ITQlick team. The software cost is considered average (2.7/5) when compared to other solutions in their category.

Shlomi Lavi / updated: Aug 12, 2020

We publish unbiased reviews, our opinions are our own and are not influenced by payments from advertisers. Learn more in our advertiser disclosure.

What is AhnLab Used For?

AhnLab is a growing cloud-based Antivirus Software software, it is designed to support small, medium and large size business. AhnLab received a rating of 3.7 from ITQlick team. The software cost is considered average (2.7/5) when compared to other solutions in their category.Average Rating

The rating of AhnLab is 3.7 stars out of 5. The rating is based on ITQlick expert review.

Typical Customers

The typical customers include the following business size: Small business, Medium business, Large business

Competitors & Alternatives

Ahnlab Mds

Popular Alternatives to AhnLab: Norton Security Standard, BitDefender Antivirus Plus 2013, McAfee 2016 AntiVirus, Webroot AntiVirus 2016, Kaspersky Anti-Virus 2016, PC Matic, ESET SMART Security, Avast Pro Antivirus - Nitro Update, Avira Antivirus Pro 2016, Panda Antivirus Pro 201.

AhnLab Pricing Information

The Antivirus Software experts at ITQlick has reviewed AhnLab pricing and gave the software a total cost of ownership (TCO) rating of 5.4 out of 10. Custom price cost for your business is available upon request.

AhnLab Categories

Specifications

| Company: | AhnLab, Inc. |

|---|---|

| Address: | USA |

| Customers: | Small business, Medium business, Large business |

| Business Area: | Cross Business Areas |

| Platforms: | Desktop, Cloud |

| Operating Systems: | Mac OS, Windows, Linux |

AhnLab Vs. Alternatives

Ahnlab Mds Agent Uninstall

Author

Shlomi Lavi

Shlomi holds a Bachelor of Science (B.Sc.) in Information System Engineering from Ben Gurion University in Israel. Shlomi brings 15 years of global IT and IS management experience as a consultant, and implementation expert for small, medium and large size (global) companies.

The office of Optimus Asset Management is shown in Seoul. (Yonhap) |

Ahnlab Hackshield

The list of investors for fraudulent hedge funds operated by South Korea’s Optimus Asset Management included leading food company Ottogi, which invested 15 billion won, and Kosdaq-listed antivirus software firm AhnLab, which invested 7 billion won, according to the local Korean Economic Daily.

The unlisted Hanwha General Chemical, Hanwha Group’s chemicals unit, made the biggest investment in the hedge fund of 50 billion won. The company, however, saw no loss in the investment, as it redeemed all the capital in September last year, an official said.

Convenience store chain BGF Retail also put in 10 billion won, while LS Electric and game company Nexon invested 5 billion won and 3 billion won, respectively.

The list also included JYP Entertainment and LS Electric affiliate LS Metal, respectively investing 4 billion won and 5 billion won, with each losing some 30 percent of their investment.

HDC and Hanil Cement also put billions of won into the funds, it added.

Besides local firms, private universities such as Sungkyunkwan University, Hannam University and Konkuk University each invested some 4 billion won. Public institutions such as the Korea Racing Authority, Korea Communications Agency and Korea Rural Community Corp. also made large investments into the fraudulent funds.

Meanwhile, Optimus Asset sold over 1.5 trillion won of their funds to over 3,000 retail investors and companies through large brokerages and banks for three years, from June 2017 to May this year.

By Jie Ye-eun (yeeun@heraldcorp.com)